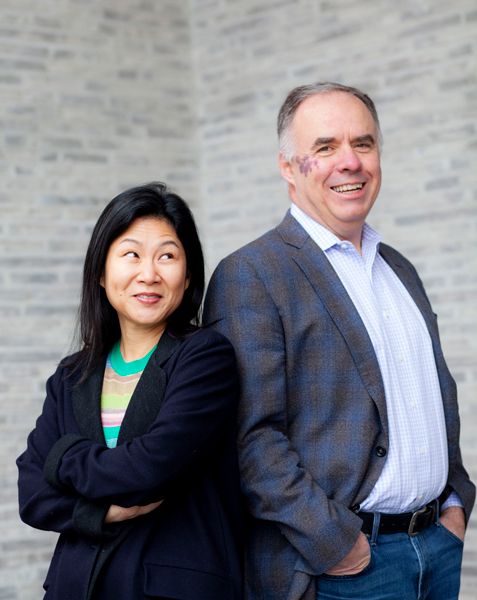

T'95

So-June Min and Liam Donohue

CFO, .406 Ventures; Founding Partner, .406 Ventures

Beginning with each other, the relationships we made at Tuck have become the foundation of both our personal and professional lives.

By Adam Sylvain

So-June Min T’95 and Liam Donohue T’95 are not the only Tuck spouses who can trace their relationship back to a randomly assigned study group. In their case, it was a study group formed as part of former Tuck professor John Vogel’s real estate course during their second year.

“There were only about 180 students in our entire MBA class, so we knew each other pretty well.” the couple recalls. “We quickly found out we had a lot in common.”

What makes their relationship more unique is that for the past 16 years Min and Donohue have also worked together at the venture capital firm .406 Ventures. Both co-founders, Donohue serves as the managing partner and Min as CFO for the firm, which invests in early-stage companies focused on digital health, cybersecurity, as well as data and cloud technology. To date, .406 Ventures has raised nearly $1.5 billion across five core and three opportunity funds with a portfolio valued at more than $13 billion.

“We get asked all the time, ‘How do you do it? How do you work with your spouse?’ The truth is, I couldn’t imagine not doing it. So-June probably could,” jokes Donohue.

Both agree their study group experience was a good primer for the inevitable challenges and triumphs that come with growing a successful life and business together. Growing up continents apart, Min and Donohue never met prior to Tuck, but their pre-MBA journeys shared a surprising overlap in Eastern Europe.

After graduating from Georgetown University, Donohue began working as a consultant for Booz Allen. Soon after, in 1989, the Berlin Wall fell, which renewed his interest in working overseas. He convinced Booz Allen to send him to Budapest in 1990 as the first employee on the ground in Eastern Europe and spent the next three years growing a team there before returning stateside for his MBA.

A Korean native, Min spent her early years in multiple places, including Berlin and Prague, where her father was an ambassador for the Korean government. Upon earning a degree in English Literature from Ewha Woman’s University in Seoul, Min joined Sunkyong Group (“SK”), the third largest conglomerate in Korea, where she helped prepare a winning bid for the nation’s first commercial cellular license.

Unsure of the career path she hoped to pursue, Min believed the right business program would help her explore opportunities. She enrolled at Tuck without ever visiting campus and was pleased to discover that what she had heard about the idyllic campus was not an exaggeration.

“My mom came to drop me off and she said, ‘Wow, this place is incredible. Why would you ever want to leave?’” remembers Min.

Donohue was equally won over by the Tuck community. During his time on campus, he benefitted greatly from the mentorship of then-dean Colin Blaydon, who introduced him to the world of venture capital, which was not a traditional career path for MBAs, let alone Tuck graduates, at that time.

“Entering Tuck, I had consulting experience advising companies, but I also had entrepreneurial experience overseas building a business and a team on my own,” says Donohue. “I also did my summer internship at an investment bank in London. From those experiences, I learned that I loved consulting and helping companies solve problems, I loved the entrepreneurial experience of creating something new, and I loved the rush of the transaction.”

As dean Blaydon told him at the time, venture capital was an area where he could integrate all these interests.

“In venture capital, you are helping companies grow, you are spending time with amazing entrepreneurs, and you are doing transactions,” explains Donohue. “It seemed to check all the boxes.”

Dean Blaydon eventually connected Donohue with John H. Foster T’67, who was then a member of Tuck’s Board of Overseers (now Board of Advisors). Foster had an opening at his Philadelphia-based venture firm, Foster Management, where he was a founder and managing partner. After graduation, Donohue became a principal at the firm.

Following their engagement, Min joined Donohue in Philadelphia where she began working for PECO Energy‘s Power Team subsidiary, now part of Exelon Corporation.

“I was a literal power broker—buying and selling electricity,” shares Min. “I give a ton of credit to my Tuck education, which really prepares you to go into any field. Even though I was not an expert, I felt well-equipped to figure it out and make my own way.”

Within a few years, Min partnered with a colleague in launching their own electricity trading fund. After experiencing some early success, the Enron scandal happened.

“Needless to say, 2001 was not a good time to be raising a fund focused on energy trading,” explains Min.

Donohue spent several years at Foster Management, which included building his first company and bringing it public. Eventually, he became intrigued by the opportunities created by the emergence of the internet in the late 90s. Foster Management’s strategy was primarily consolidation—buying and building companies through acquisition—but Donohue was increasingly interested in early-stage venture capital.

In 1999, he founded Arcadia Partners, raising a $50 million fund invested in health and educational technology. Min later joined Arcadia as CFO. The firm was considering raising a second fund when Donohue met his two additional co-founders at .406 Ventures.

Since launching in 2006, .406 Ventures has grappled with the 2008 Global Financial Crisis the COVID-19 pandemic and is currently navigating the technology sector sell-off. Donohue and Min believe much of their success is owed to having a consistent strategy—acknowledging their firm’s strengths and focusing their investments in areas that .406 knows well and can “hit out of the park.”

Fittingly, .406 Ventures is named after Red Sox legend Ted Williams’ record-high batting average.

In addition, .406 has always believed it is critical for its investment team to possess operational experience.

“If you have only seen the work of growing a business from the vantage point of a consultant or a banker, you don’t have the same credibility or empathy,” says Donohue. “To succeed in venture capital, you need to be able to identify businesses that are led by authentic entrepreneurs who are really focused on solving big problems and doing it in a capital-efficient way.”

.406 Ventures also stands apart for its diversity. Including fellow cofounder and managing partner Maria Cirino, half of the investment team and 65% of the firm’s employees overall are women. Min says she is excited about the larger shifts happening throughout the industry.

“Compared to years past, VC firms are definitely hiring more women” says Min. “It is a trend that is long overdue, but also very encouraging.”

A final key ingredient to their success, Min and Donohue recognize the value in .406’s high concentration of Tuck graduates, which includes partner Graham Brooks T’02 and Chief Marketing and Communications Officer Joanna Skoler Gillman T’95. During the past 25 years, more than a dozen of their T’95 classmates have worked at or been on boards of .406 portfolio companies. Factoring in all Tuck alumni, that number swells to more than 100.

“Beginning with each other, the relationships we made at Tuck have become the foundation of both our personal and professional lives,” shares Min.

The Pros & Cons of Working with Your Spouse, According to So‑June & Liam

Pros

|

Cons

|

This story originally appeared in print in Tuck Today.

Continue Reading

Related Stories

Driving Innovation to Better the World: Meet Tom Park T’10

Tom Park T’10 shares how he’s innovating in Canada’s tech sector and supporting Asian professionals through the Asian Canadian Ventures Collective.

Read More“Rise to the Challenge”: Sarah Schwarzschild T’08’s Path to Leadership in Private Equity Real Estate

With an ability to recognize untapped opportunities, MAVIK COO Sarah Schwarzschild T’08 has charted a fast-rising career in private equity real estate, excelling in what was once considered a niche segment of the investment market.

Read MoreDOING WELL BY DOING GOOD: Meet Nespresso CFO Hilary Halper T’07

Hilary Halper T’07, CFO of Nespresso, reflects on the company’s sustainability focus and the increasingly strategic role that CFOs play in business today.

Read MoreThe People-First Manager

Leading with integrity and a keen focus on the human side of banking, Interbank CEO Luis Felipe Castellanos T’98 is helping build a better future for Perú’s middle class.

Read MoreThe Resilient Founder: Sarah Ketterer T’87, CEO of Causeway Capital

As Sarah Ketterer T’87, CEO of Causeway Capital Management, will attest, weathering the inevitable storms that arise in global financial markets requires ample grit, teamwork, and humility.

Read MoreA Winning Story: Meet Crunchyroll CFO Travis Page T’10

As the CFO of Crunchyroll, a specialty streaming service that boasts 120 million users, Travis Page T’10 is leveraging his varied experience in the media and entertainment space to bring the Japanese art form to a wider audience.

Read MoreHow to Shake Up an Industry, with Tomo Cofounder Carey Schwaber Armstrong T’10

Carey Schwaber Armstrong T’10, cofounder of Tomo, is working to transform the homebuyer experience.

Read MoreBridging the Generational Divide: Meet Kinsome Cofounder Eben Pingree T’13

With his latest venture, Kinsome, cofounder Eben Pingree T’13 is helping deepen bonds between grandparents and their grandkids through an AI-powered social journaling app.

Read MoreClosing the Financing Gap for Local Businesses: Meet Honeycomb Cofounder George Cook T’17

Honeycomb Credit works specifically with small businesses and allows consumers, nonprofits, and other organizations to loan small amounts of cash to a particular venture.

Read MoreThe Uber for Customer Support: Meet Chatdesk Cofounder Andrew Olaleye T’13

Contacting customer service feels like a chore to most consumers. But Chatdesk cofounder Andrew Olaleye T’13 says the exchange doesn’t need to feel dreadful.

Read MoreAddressing the Opioid Crisis through the Power of Community: Meet Steve Kelly T’18

As cofounder of Boston-based Better Life Partners, Steve Kelly T’18 is focused on providing same-day treatment for opioid use disorder by tapping into a network of community organizations.

Read MoreMaking the Most of Time at the Laundromat: Meet Courtney Bragg T’18

For Courtney Bragg T’18, founder of Fabric Health, the key to helping the millions of low-income people across the country started in an unlikely place—the laundromat.

Read MoreBuilding Solutions for the Childcare Crisis: Meet Shefali Shah T’09

Upfront cofounder Shefali Shah T’09 has long wanted to be a part of the solution for one of the country’s most pressing problems: increasing high-quality affordable childcare for all.

Read MoreMeet Stemless Cofounder Koushi Sunder T’13

With Stemless, entrepreneur Koushi Sunder T’13 is offering solutions for the emerging cannabis industry.

Read MoreSweet Success: Meet Entrepreneur Sarah Bell T’14

A conversation with Sarah Bell T’14, cofounder of Spring & Mulberry, a plant-based, naturally-sweetened chocolate brand.

Read MoreBuilding a Better Burrito: Meet Red’s Founder Mike Adair T’09

Mike Adair T’09, CEO of Red’s All Natural, credits his Tuck experience with helping him launch a leading brand in natural frozen foods.

Read MoreWalk of Faith: Meet Grain Management Founder David Grain T’89

“If you are pushing hard and facing an unusual amount of resistance, it’s probably not ‘go time’ yet,” says David J. Grain T’89, founder and CEO of Grain Management, LLC.

Read MoreEntrepreneurial Spirit

Biochemistry and business are an optimal blend for founder and former CEO of High West Distillery David Perkins T’90.

Read MoreAt BCG, A Small-Team Approach: Meet Cristina Henrik T’08

A conversation with Cristina Henrik T’08, managing director and partner at the Boston Consulting Group, on how private equity has evolved and what has stuck with her since her Tuck days.

Read MoreLeading with Purpose: Bank of America CFO Alastair Borthwick T’93

Alastair Borthwick T’93, CFO at Bank of America, reflects on his Tuck experience and the people-first approach that drives his success as a financial leader.

Read MoreWhy We Need More Women Entrepreneurs—And Investors

A conversation with venture capitalist Elizabeth Davis T’20, an investor with the Anthemis Group’s Female Innovators Lab.

Read MoreBlair Crichton

Meet Blair Crichton T’18, co-founder of Karana, a new whole-plant based meat company launched in Singapore.

Read MoreMeet Jose Minaya T’00

A commitment to building diverse, inclusive, and equitable structures across organizations is personal for Jose Minaya T’00, who was named CEO of Nuveen in 2020.

Read MoreMeet Allobee Chief Strategy Officer Anne Forsyth English T’08

Allobee is connecting business owners nationwide to an underutilized workforce of experienced, professional women—a mission that deeply resonates with Chief Strategy Officer Anne Forsyth English T’08.

Meet Military Veteran and Fitfighter CEO Sarah Apgar T’11

A commitment to public service is a current that runs through T’11 Sarah Apgar’s career and education.

Read MoreMeet Tuck Alumnus Richard Noyes of Bartlett Associates

Meet Tuck Alumnus Richard Noyes of Bartlett Associates

Read MoreNoreen Doyle

Noreen Doyle T’74, chair of the Newmont Mining Corporation, was the first woman to chair the British Banker’s Association in its 96-year history.

Read MorePreserving Culture Through Banking: Meet Dawson Her Many Horses T’10

Dawson Her Many Horses T’10, SVP & Native American business leader at Wells Fargo, helps Native American tribes protect their way of life.

Read MoreLaura Scott

At Wayfair, Tuck alumna Laura Scott completely transformed the company’s operations. Now she’s dipping her toes into the startup world with Takeoff Tech.

Read MoreTuck Alumnus Named Head of Goldman Sachs’ Global Securities

At Goldman Sachs’ Global Securities Division, Tuck Alumnus Jim Esposito orchestrates a global operation managing risk for asset managers, pension funds, insurance companies, hedge funds, corporations, and governments.

Read MoreThe Guru’s Wisdom

CarGurus founder Langley Steinert T’91 has plenty of good advice for budding entrepreneurs, but nothing is more important than loving what you do.

Read MoreBringing Order to the Chaos

Solving complex problems is what's kept Diego Ferro T'93 in finance for 25 years. Here's what he's learned.

Read MoreJuliet Horton

With Everly, Juliet Horton T’14 is changing how couples plan their wedding

Read MoreHow to Make a Successful Startup Pitch

In her seven years as a venture partner at LaunchCapital in Cambridge, Mass., Heather Onstott T’07 has heard about 1,000 pitches from startups.

Read MoreSusan Hunt Stevens

In 2006 Susan Hunt Stevens T'98 started a blog as a "a guide to going green without going berserk." Years later the idea evolved into WeSpire, a platform that uses technology and social media to promote sustainable living.

Read MoreKinya Seto

CEO of Lixil Corporation Kinya Seto T'96 is leveraging his entrepreneurial smarts to tackle the global sanitation crisis.

Read MoreKatrina Veerman

With PK Coffee in Stowe, Vermont, Katrina Veerman T’01 turned a passion into a livelihood.

Read MoreRick Cardenas

T’98 Rick Cardenas’ first job was bussing tables at a Red Lobster. Fast forward 30 years and he’s now CEO of Darden Restaurants which, until 2014, owned Red Lobster.

Read MoreLindsey Drake

Fun Finance: Lindsey Drake T’11 talks about her role as a senior finance manager at Amazon Books.

Read MoreJames “Jim” Lindstrom

Jim Lindstrom T’01 has a career of both investment and senior operational roles—a unique perspective to lead a multinational corporation in today’s dynamic environment.

Read MoreAndrew Smith

Andrew Smith T'07 chose Tuck first because he was looking for a beautiful environment where he could spend time thinking about how to maximize his impact on big challenges in the world.

Read MoreTracy Sun

Poshmark co-founder Tracy Sun T’05 turned her love of fashion and psychology into a leading mobile commerce app. Shopping will never be the same.

Read MoreGibson “Gib” Biddle

NerdWallet's Gib Biddle T'91 came to Tuck as a marketer, but then realized he was more of a builder.

Read MoreRohit Dugar

Former investment banker Rohit Dugar T'07 is transforming his beer-brewing hobby into Hong Kong's first craft brewery—and using his Tuck experience to navigate the challenges of entrepreneurship.

Read MoreDeb Kemper

As managing director of the Boston Forum of Golden Seeds, a national network of angel investors funding early-stage companies led by women, Deb Kemper T'95 lives by the motto: be the change you want to see in the world.

Read MoreKathryn Baker

Kathryn Baker T'93 is a true expert on boards of directors. She has served on more than 20 of them over the last 16 years, ranging from oil and gas companies to Norway’s Central Bank to Tuck’s own European Advisory Board.

Read MoreJie Lian

The Chinese economy has grown tremendously since 1989, and so have the opportunities for enterprising Tuck graduates, like Jie Lian T'01.

Read MoreOn Networking

Not many people in ball bearing sales finish their careers in venture capital. For Mike Carusi T’93, now one of the most successful health care investors in Silicon Valley, that unlikely journey started with two eye-opening years at Tuck.

Read MoreCollette Chilton

Williams College chief investment officer Collette Chilton T’86 is helping deliver big returns for the Little Ivy.

Read MoreJack O’Toole

For Jack O’Toole T’14, “building” and “contributing” are words to live by. As a Marine, he did both.

Read More