What’s Happened to Volatility Trading?

Tuck professor Ing-Haw Cheng says it’s buyers that have disappeared.

"A simpler possibility hasn’t been talked about as much: Demand for long futures may have fallen off significantly," says Cheng.

The VIX is the talk of the town again. After averaging a sleepy 11% in 2017, Wall Street’s “fear gauge” leapt to 37% in early February.

It’s declined quite a bit since then, but it’s still averaging 20 per cent. “This is the first time in years when volatility has jumped and remained high,” says Macro Risk Advisors.

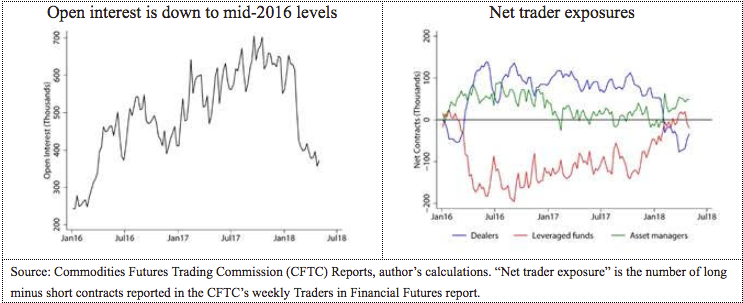

Still, trading on the VIX is down. After rapid growth in volatility trading – a “volatility virus” that infected Wall Street, reported the Financial Times – open interest in VIX futures has declined to levels not seen since mid-2016. Volumes and trader exposures are down too; some are worried that the entire VIX derivatives market, or the VIX itself, is in trouble.

What’s changed? A common narrative is that, after amazing returns in 2016 and 2017, short volatility traders were annihilated in February’s Vix-mageddon and haven’t come back. As the FT notes, investors may be more skeptical of exchange-traded products linked to VIX futures; others are increasingly concerned about manipulation of the VIX.

But here’s a simpler possibility that hasn’t been talked about as much: Demand for long futures may have fallen off significantly.

Let’s back up. What is a VIX futures contract? At a basic level, a VIX futures contract is a bet between two parties on what the VIX will be on a specific date in the future; say, June 20th. Suppose I take the long side and you take the short side of the contract, and we hold the contract until June 20th. If, on that morning, the VIX is higher than the initial futures price, I will make money, and you will lose money. One way to think about this is that a long VIX futures position insures against rises in the VIX; a short position means writing the insurance.

It’s problematic to reason, as the common narrative does, that open interest is down because short investors were burned and are not interested anymore. After all, there’s a buyer and seller for each contract. The number of contracts outstanding could have fallen because insurance demand from long investors has fallen, not just the willingness of short investors to write the insurance.

The problem with this reasoning can be seen in the following charts:

Since the 2008 financial crisis, there have been two key groups of traders: dealers, who tend to take long positions, and leveraged hedge funds, who tend to take short positions.

After starting to take large bets in 2016, both groups began reducing their exposure beginning in late 2017, with a sharp drop in February 2018 as the VIX spiked.

Open interest tells a similar story. It’s possible that hedge funds might have been more reluctant to write insurance starting in late 2017, but it’s also possible that dealers – or the clients behind dealer’s positions – didn’t want to buy insurance anymore. In fact, dealers have gone net short since February.

To disentangle what's happened, it also helps to look at how traders made money from what can be thought of as an insurance premium built into VIX futures.

On average, today’s VIX futures price tends to be higher than where the future VIX winds up. For example, if today’s VIX is 14 and the futures price for June 20 is 18, we might expect the VIX to rise over the next few weeks but it typically will not go all the way up to 18. If the VIX winds up at, say, 17 on June 20, this would result in profit for the short and a loss for the long position. The average profit to the short is akin to an insurance premium paid by the long side.

The profit, or premium, is a regularity, not an iron law. At any moment, one can estimate the expected shorting profit by looking at today’s VIX futures prices and subtracting a statistical forecast of the future VIX constructed in real time.

Right now, those estimates of expected shorting profits are low by historical standards. They began sliding towards the end of 2017, took a massive dive into negative territory when the VIX spiked in February, and have been climbing back since then.

As a card-carrying financial economist, my starting point for why the expected profitability of an investment strategy falls is that its risk falls. In the case of VIX futures, the evidence for this is murky at best.

The market beta of shorting VIX futures was hovering under 5 before February. Several other relevant risk measures such as market volatility or the volatility of the VIX were rising, as expected shorting profits slid down toward the end of January. In fact, a short investor who saw that expected profits had slid into negative territory at the end of January, and fortuitously acted on this signal to get out of their short, would have dodged massive losses when the VIX spiked in February.

It’s true that other latent risks that may explain these patterns. But a simple and rational explanation for the fall in expected shorting profits – really the insurance premium paid by long investors – is that the usual buyers of insurance (dealers) don’t want to buy insurance like they did before.

Such an explanation squares with the fall in trader exposures discussed above. In contrast, the idea that hedge funds don’t want to write insurance anymore doesn’t sit so squarely, as their disinterest should have increased premiums, all else equal.

In other words, from the observation that insurance premiums and trader exposures have been falling together, we can deduce that it is likely the usual buyers of the insurance, not the sellers, who went away and have yet to fully come back.

Is this reading too much into one event? Perhaps. Several questions need answering. Why did dealers reduce their long volatility positions (i.e., their insurance) if risk was rising? Why are they short now? Why did the expected profit from shorting not only decline, but flip from positive to negative?

Not all facts fit together so conveniently, nor will they ever. But my research, published in a recent paper, suggests the key features of this most recent episode are not unique and fit historical patterns in VIX futures.

The data in the study ended in 2015, but even before then, insurance premiums and trader exposures tended to fall together as risk rose, suggesting falling demand for long futures. The study also shows that estimates of expected short profits aren’t crazy: they tend to forecast subsequent realized profits.

So, in the discussion of what happened to short investors and potential manipulation in the VIX, let’s not forget a key question: what has been going on with long volatility investors?

Originally published by the Financial Times.