The speed of the fall in the stock market and increase in market volatility over the past month has been stunning.

From mid-February highs, the S&P 500 is down substantially, and the VIX, a gauge of volatility in the stock market, spiked to reach an all-time high of 83. Did the market under-appreciate the risk of a full-blown coronavirus pandemic?

An important clue suggests that the market was indeed a step behind in appreciating the risks that a pandemic posed. The clue comes from the somewhat obscure, but highly traded, VIX futures contract market. The VIX is a widely followed gauge of market volatility, and the VIX futures market is akin to a prediction market for where the VIX will be in the future.

Associate Professor of Business Administration Ing-Haw Cheng teaches Futures and Options Markets at Tuck.

As a starting point, it seems reasonable to wonder whether markets were completely wise to the risks of the coming pandemic before this all started. On February 19, the S&P 500 closed at a record high just 14 points shy of 3400. The VIX closed around 14; a value which was, as with most days over the bull market of the preceding years, well below its historical average of 20. These events occurred even though the first U.S. case of the COVID-19 coronavirus had been reported in the mainstream news and confirmed by the CDC on January 21. The news out of China had been dire; on February 12, the media reported 14,000 new cases in Hubei Province alone.

By March 2, coronavirus cases were spiking in Europe, and the U.S. had reported possible community spread as well as its first coronavirus-related death. The S&P 500 had fallen to just under 3100. The VIX had risen to 33, certainly a large increase from 14. But did that reflect a full appreciation of the growing risks in the market?

On March 2, with the VIX at 33, the futures contract expiring March 18 settled at a futures price of 26, suggesting that markets expected the VIX to fall 7 points over 16 days. The VIX tends to move predictably back towards its long-term average—let’s call that 20—so even though things turned out worse later, the forecast of 26 at the time did not seem unreasonable.

But because the VIX tends move back toward its average, we should ask: On March 2, with the VIX at 33, where would a statistical model put the VIX as of March 18? Using well-known techniques I discussed in a 2019 article published in the Review of Financial Studies, a statistical model estimated using the history of the VIX would have produced a forecast just exceeding 30.

The key observation is that the futures price fell below the fair forecast. It’s usually the other way around: the futures price typically exceeds the fair forecast of the VIX. … Instead, with prices below the fair forecast, investors in the VIX futures market were a step behind the forecast in assessing how bad things would get.

Both forecasts turned out to be far wide of the mark: things got worse fast. The VIX ended up around 70 by March 18. Because the futures price was below the statistically fair forecast, investors had expected more volatility to subside than the fair forecast.

The key observation is that the futures price fell below the fair forecast. It’s usually the other way around: the futures price typically exceeds the fair forecast of the VIX. The reason is that a trader who buys a VIX futures contract hedges higher uncertainty and thus pays a higher-than-fair price. Instead, with prices below the fair forecast, investors in the VIX futures market were a step behind the forecast in assessing how bad things would get.

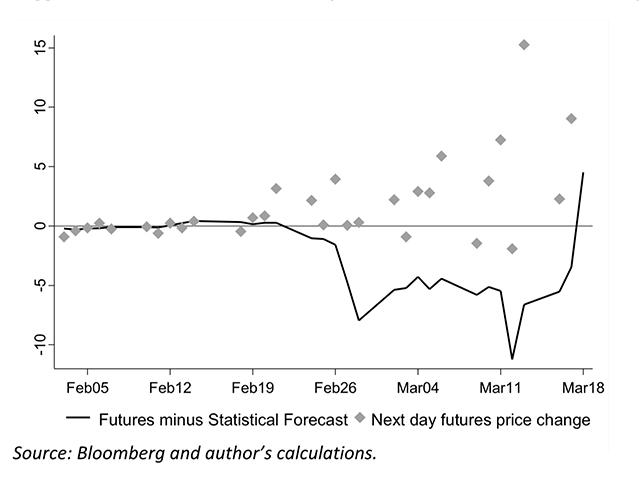

Investors weren’t just a step behind the fair forecast on March 2, either. As the graph below shows, starting on February 24, futures prices fell below contemporaneous statistical forecasts of the VIX for over two weeks. Crucially, there is a tendency for futures prices to shoot up following such days. This suggests that investors were over-optimistic about how much volatility would subside.

This type of pattern isn’t just due to chance or a bad statistical model but rather under-appreciation of growing risks in the market. In the Review of Financial Studies article, I document that, throughout the history of the VIX futures market, futures prices tend to fall below statistically fair forecasts as market risks grow, but that there is nevertheless a tendency for futures prices to subsequently move toward the fair forecasts. Most prominently, VIX futures prices fell below the fair forecasts on the eve of episodes spanning a rogue’s gallery of major market turmoil such as the 2008 financial crisis. Even in these episodes, futures prices subsequently adjusted upward as investors caught on to impending risks.

So far, this episode seems strikingly similar: Investors in the VIX futures market were a step behind in appreciating the growing risks to the market as the coronavirus pandemic spread.

A version of this op-ed was originally published by MarketWatch on April 4, 2020.

Ing-Haw Cheng is an associate professor of business administration at Tuck where he teaches Capital Markets and Futures and Options Markets. His current research topics include beliefs, incentives, and risk-taking.