Finance Questions, Answered

Seven of Tuck’s finance faculty answer questions from their research and experience.

By Kirk Kardashian

Sep 09, 2022

Finance at Tuck is a wide-ranging subject that goes well beyond the stereotypical areas of borrowing and investing. Faculty members in the Finance group use empirical, data-based methods to study how individuals, institutions, and firms make financial decisions and how those decisions affect real outcomes.

As you’ll read below, in this seven-part sample of the finance faculty’s research, they study the broad areas of corporate finance, household finance, and asset pricing. In corporate finance, faculty examine corporate governance, the investment choices of corporations and nonprofits, CEO performance, and corporate borrowing and bankruptcy. Tuck’s experts in household finance study the effects of payday loans, the gig economy, personal bankruptcy, financial advice, and the role of collateral lending in small business starts. And Tuck’s asset-pricing experts are well-known for their work on risk and return in the stock market, mutual fund trading and performance, and investor behavior and performance.

These subjects take shape in myriad ways, and they undergird economics at every level from individuals to global corporations and even entire markets. This is evident in the topics below, which include volatility and the average investor; gender quotas on corporate boards; CEO overconfidence; text mining for financial insights; gig workers’ access to credit, and more.

If you’ve been watching the stock market lately, you’ve probably noticed that stock prices are swinging wildly up and down from one day to the next. According to the New York Times, since the start of 2022, one in every nine trading days has closed with a change of 2.5 percent or more. Continue Reading

Despite what Ken French argues in his research related to market volatility, academics have long been uncovering many trading rules that seem to promise a higher return than one would reap from investing in index or mutual funds. Continue Reading

On August 8 of 2022, diversity at the top of the corporate ladder took a giant step into the spotlight. That’s the day all 3,300-plus companies listed on the Nasdaq stock exchange were required to publicly disclose their board-level diversity statistics using a standardized template. Continue Reading

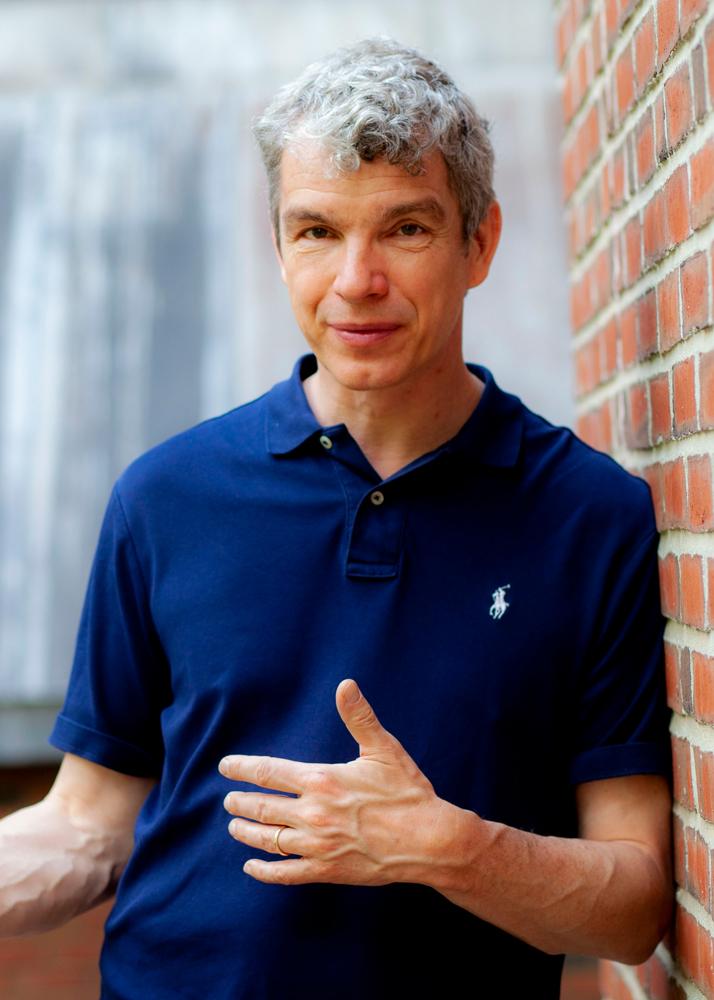

For the past 15 years, Tuck professor Morten Sorensen has been analyzing a unique dataset of executive assessments of CEOs. He and his colleague Steven N. Kaplan have used the data to better understand what makes CEOs effective, and how they differ from other top executives, such as CFOs and COOs. Continue Reading

If you think back to the run-up to the financial crisis of 2008, the drivers of the increase in prices were multiple and interdependent: lax credit standards, and high demand for credit were the common explanations. For Tuck professor Felipe Severino, one important lesson from that dark period in economic history is that beliefs play a significant role in how lenders allocate credit, but also why people decide to become homeowners. Continue Reading

Gordon Phillips had a problem. He was trying to answer financial and economic questions about corporations and industries, but the usual data out there was just no good for many firms. Continue Reading

All over the globe, gig work is on the rise. In the European Union, where regulations penalize firms for layoffs, companies hire temporary workers so they can scale up or down quickly, as the economy changes. In the U.S., gig work for companies like Uber is attractive for workers because they can have the flexibility to put in hours when they want. Continue Reading

This article was originally published in print in Tuck Today magazine.